A holistic approach to financial wellbeing

Introducing Financial Navigator

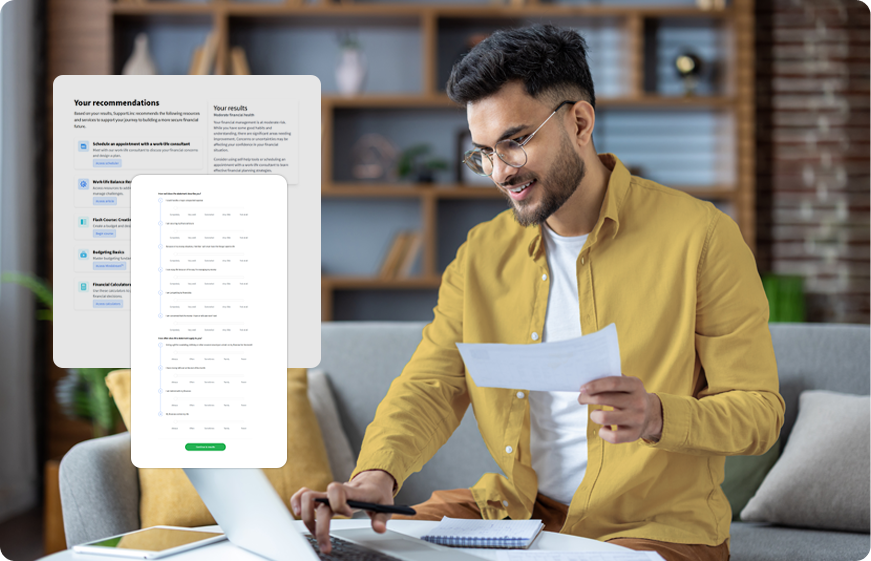

Employees who feel financially insecure are more likely to experience anxiety, distraction and burnout, which can ripple into their performance and overall wellbeing. Financial Navigator is designed to help employees take actionable steps toward financial security and improved mental health while enabling employers to drive meaningful workplace outcomes.

How Financial Navigator works

Each participant is guided through a personalized financial wellness journey with access to comprehensive tools and resources tailored to their unique situation.

These include:

- A confidential financial assessment accessible via desktop and mobile to evaluate financial strengths and areas for improvement

- A personalized financial health score, complete with insights to help participants understand their unique financial situation

- Pathways to success, delivering tailored recommendations for budgeting, debt management, savings and long-term planning

- The ability to schedule an appointment with work-life consultants and financial experts for in-depth discussions on goals, challenges and next steps

The hidden cost of financial stress in the workplace

Financial stress doesn't clock out when employees clock in. It's a silent productivity killer, leading to decreased focus, increased absenteeism, and higher turnover rates. Discover how integrating comprehensive financial wellness programs into your benefits package isn't just good for employees—it's a strategic move for your business's bottom line.

Empower your workforce with financial confidence

With Financial Navigator, members can confidently assess their financial health and take actionable steps toward a brighter, more secure financial future. Contact us to learn more.